With the current cost-of living crisis, many of us are feeling the pinch, but one man detailed just how little he is left with each month.

TikTok user Dilfboobs - what a name by the way - posted a video breaking down what he spends his money after revealing he is earning the most in his life at $50k.

The clip has since gone viral with almost 3 million views on the platform and many social media users have empathized with his struggle.

Advert

Explaining his reasonable expenses, the TikToker questioned how he was going to be able to ever get his foot on the property ladder if he is unable to save more than $10 a month, despite his earnings.

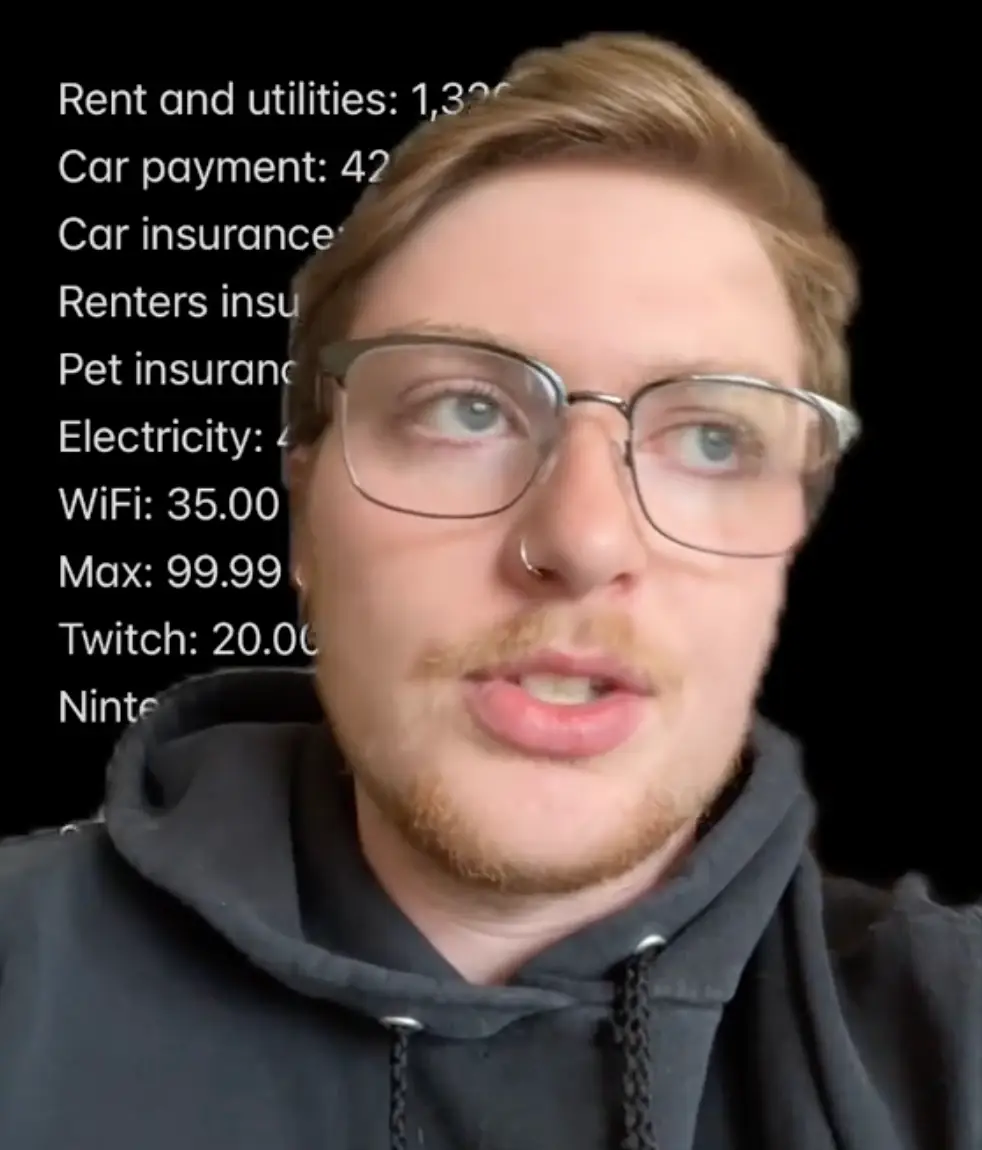

The social media user highlighted that every month, after taxes, his take home each month was $2,496.12.

His monthly rent and utilities are $1,320, car payments are $420, car insurance is $200, renter’s insurance is $12.30, pet insurance is $44.98, electricity is $40, Wifi is $35, Max (formerly HBO max) is $99.99 a year, Twitch is $20 and Nintendo subscription is $6.

The TikToker said this left him with $300 left a month.

Unfortunately, this $300 isn’t just his to spend as he pleases, however, as he said $200 of it goes on groceries, $60 on gas and another $30 on pet supplies.

Leaving him with just about $10 dollars left, which if he was a child would be fine to treat himself to some sweets, but as an adult it is concerning to be left with so little each month.

Other social media users seemed to agree and commented that they too were struggling with how expensive life has gotten, with many others also growing frustrated with comments that oversimplify the ongoing economic turmoil.

“It is just absolutely insane because after all this, I just have 10 dollars left over,” the TikTok user said during the video.

“I don’t really understand how these Boomers and older people are telling us just budget better, do this and this when this is already my bare minimum budget.

“It is not like I am buying coffee every day, it’s not like I’m doing all these things they tell you not to do.”

He went on to say that he is currently in grad school and has some credit card debt that he needs to paid off as well, so the prospect of one day getting a house is seeming even less likely.

In all honesty, it is unlikely he is alone in wondering how he will be able to buy a house in the future.