A father and son have been convicted of orchestrating a huge $20 million lottery scam.

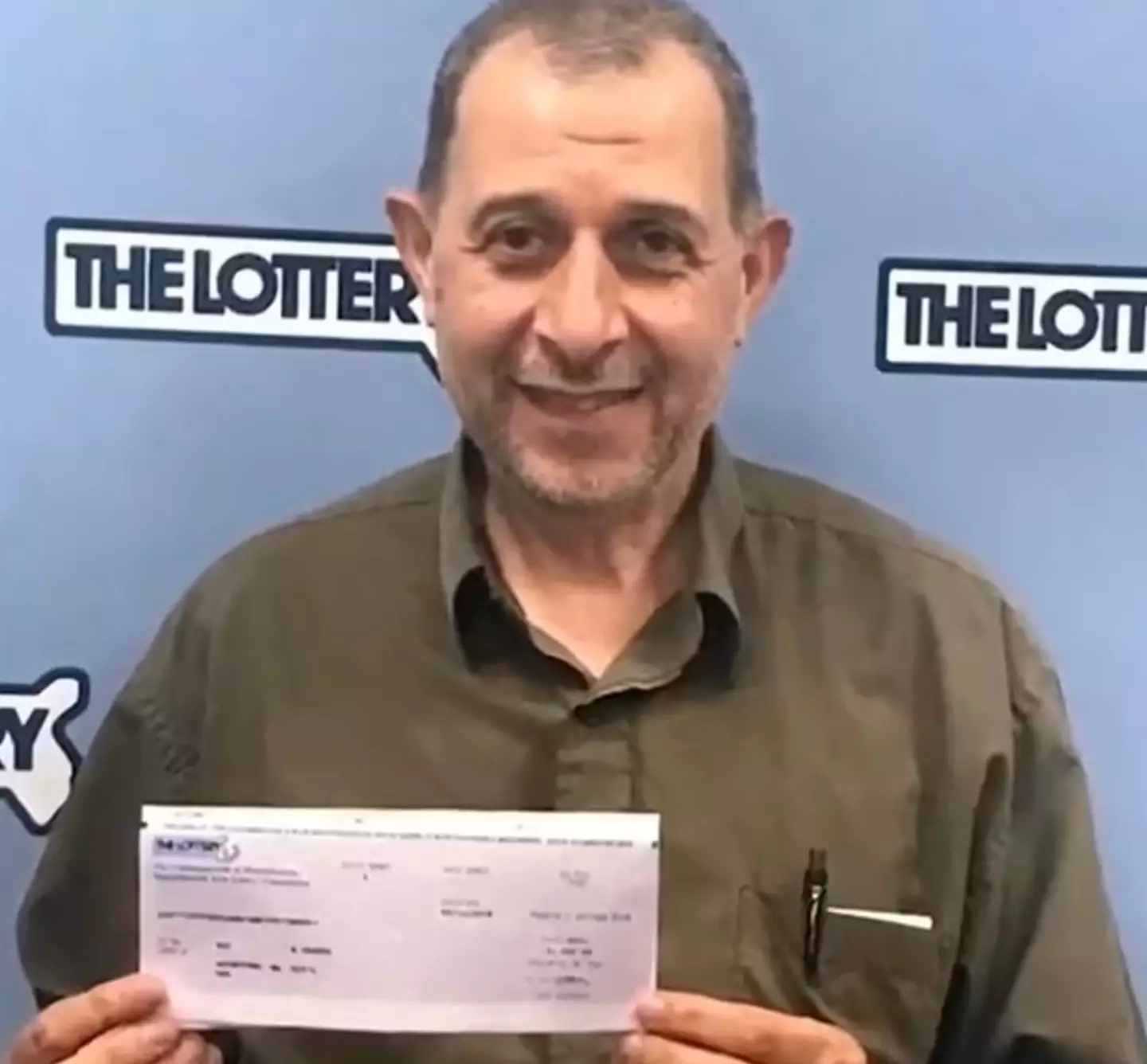

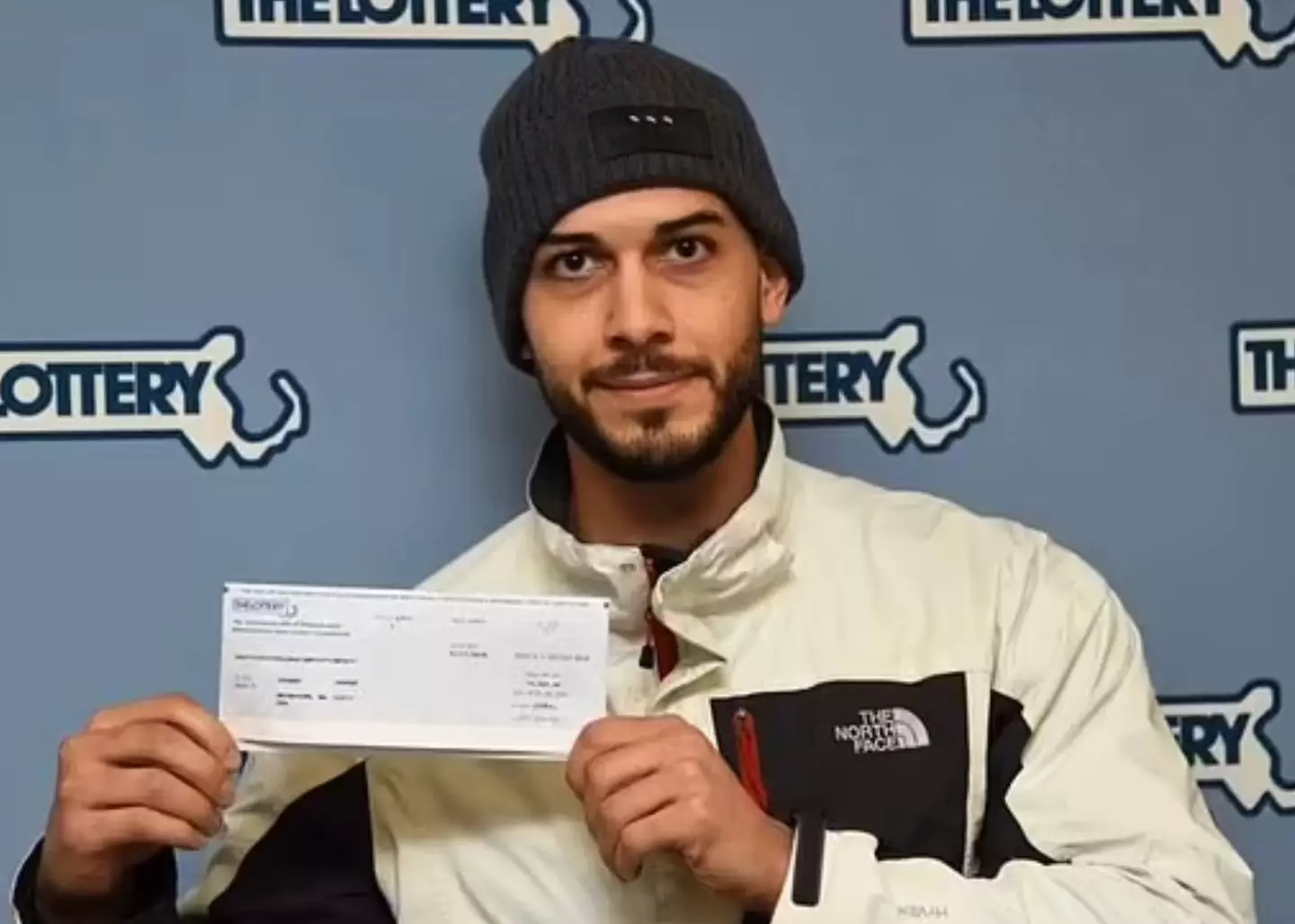

Ali Jaafar, 63, and Yousef Jaafar, 29, from Massachusetts were found guilty last week of money laundering and tax evasion, the US Attorney's Office confirmed.

For almost a decade, the pair cashed in over 14,000 lottery tickets, having bought them for a significant discount from the actual winners, typically between 10 and 20 percent of the ticket's value.

The practice, known as '10 percenting', allows the real winner to avoid reporting the winnings on their tax returns.

Advert

According to the Attorney's Office, Ali and Yousef would often use convenience store workers to help facilitate these transactions.

In total, the father and son duo claimed over $20m in Massachusetts Lottery winnings.

In 2019 alone, Ali was the top lottery ticket casher in the state, while his other son Mohamed Jaafar was the third highest individual ticket casher and Yousef was the fourth highest.

Advert

Overall, all three of them took home over $1.2m in tax refunds after claiming other people's lottery tickets, winnings which they offset by faking gambling losses on their tax returns.

During their closing arguments, United States Attorney Rachael S. Rollins said: "That's not luck, it's fraud."

Last month, Mohamed pleaded guilty to conspiracy to defraud the Internal Revenue Service. He is scheduled to be sentenced on 8 March 2023.

Ali and Yousef were were convicted on one count of conspiracy to defraud the Internal Revenue Service, one count of conspiracy to commit money laundering and one count each of filing a false tax return.

Advert

They will be sentenced on 11 and 13 April, respectively

The father and son face over 20 years in prison for their crimes, and hundreds of thousands of dollars in fines following the conviction.

The charge of conspiracy to defraud the Internal Revenue Service is punishable with up to five years in prison, three years of supervised release, a fine of $250,000 or twice the gross gain or loss, whichever is greater, and restitution.

Advert

Conspiracy to commit money laundering provides for a sentence of up to 20 years in prison, three years of supervised release, a fine of $500,000 or twice the value of the property involved in the transaction, whichever is greater, restitution and forfeiture.

And the charge of filing false tax returns provides for a sentence of up to three years in prison, one year of supervised release and a fine of $250,000 or twice the gross gain or loss, whichever is greater.

"By defrauding the Massachusetts Lottery and the Internal Revenue Service, the Jaafars cheated the system and took millions of hard-earned taxpayers’ dollars," added Rollins.

"This guilty verdict shows that elaborate money laundering schemes and tax frauds will be rooted out and prosecuted."