FTX has filed for bankruptcy in the US, while Sam Bankman-Fried has stepped down as chief executive but will remain on in an advisory role.

FTX has been through a stunning financial implosion this week, which saw the 30-year-old wipe $16 billion (£13.9b) off his net worth.

Bankman-Fried was a big name in the industry and saw FTX become the second largest cryptocurrency exchange in the world.

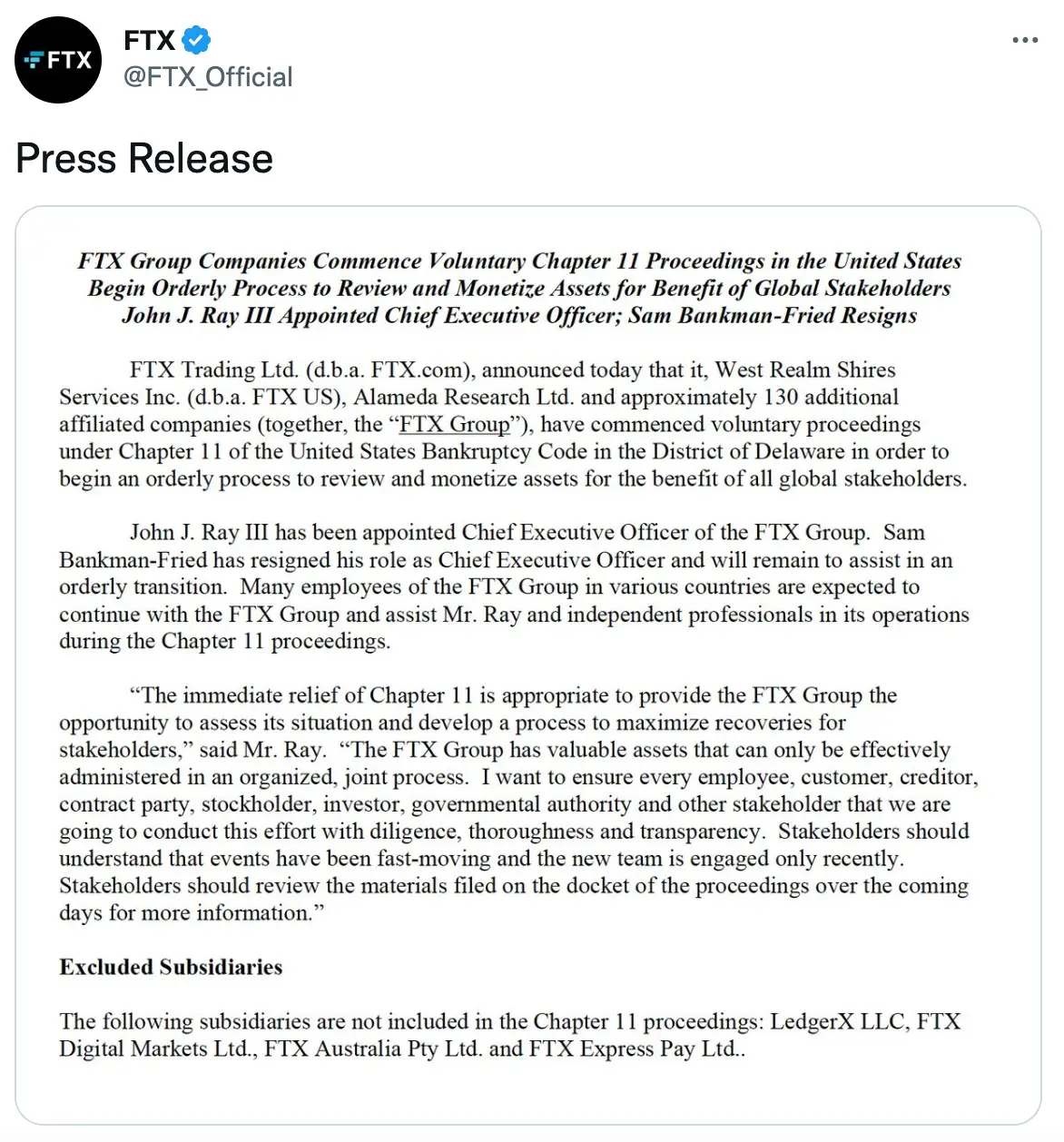

FTX has said lawyer John J. Ray III will take over as CEO as it continues forward with bankruptcy. Ray previously oversaw the liquidation of Enron when it collapsed in 2001.

Advert

In a thread on Twitter earlier today, Bankman-Fried said: “Hi all: Today, I filed FTX, FTX US, and Alameda for voluntary Chapter 11 proceedings in the US.

“I'm really sorry, again, that we ended up here. Hopefully things can find a way to recover. Hopefully this can bring some amount of transparency, trust, and governance to them.

“Ultimately hopefully it can be better for customers.

“This doesn't necessarily have to mean the end for the companies or their ability to provide value and funds to their customers chiefly, and can be consistent with other routes. Ultimately I'm optimistic that Mr. Ray and others can help provide whatever is best.

“I'm going to work on giving clarity on where things are in terms of user recovery ASAP.

“I'm piecing together all of the details, but I was shocked to see things unravel the way they did earlier this week.

“I will, soon, write up a more complete post on the play by play, but I want to make sure that I get it right when I do.”

Things started to go wrong earlier this week, when rumours swirled that FTX and other companies owned by Bankman-Fried were on unsteady financial ground.

The rumours led to a scramble from those who held funds with FTX to withdraw their money.

Bankman-Fried attempted to organise a bailout, but was unsuccessful, meaning many customers were able to access their money.

A Chapter 11 bankruptcy means the company is able to continue operating while restructuring its debts under court supervision.

In the filing, FTX estimated it had between $10 billon (£8.4b) and $50 billon (42.2b) in assets and liabilities and more than 100,000 creditors.

FTX has said it hopes to ‘begin an orderly process to review and monetize assets for the benefit of all global stakeholders’.

Topics: US News, Cryptocurrency, Money